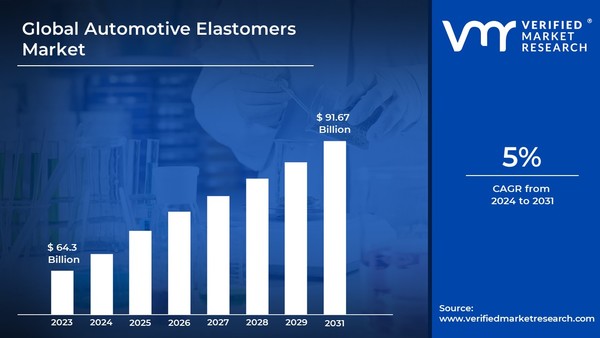

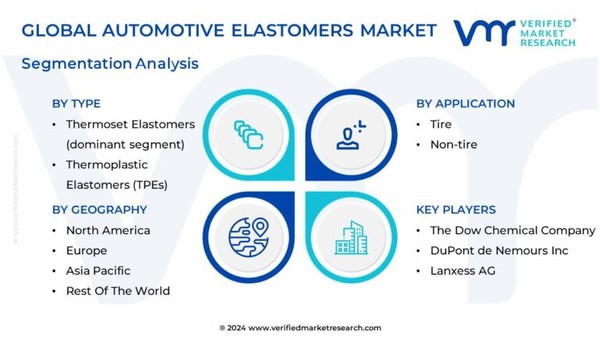

Global Automotive Elastomers Market Size By Type (Thermoset Elastomers, Thermoplastic Elastomers), By Application Type (Tire, Non-Tire), By Geographic Scope And Forecast Automotive Elastomers Market Size And Forecast Automotive Elastomers Market size was valued at USD 64.3 Billion in 2023 and is expected to reach USD 91.67 Billion by 2031, growing at a CAGR of 5% from 2024 to 2031. Global Automotive Elastomers Market Dynamics The key market dynamics that are shaping the global automotive elastomers market include: Key Market Drivers: Increasing Demand for New Vehicles and Rising Consumer Disposable Income: A increasing worldwide population and urbanization, particularly in emerging countries, are driving an increase in demand for personal vehicles. This translates immediately into an increased demand for all vehicle components, including elastomers. Furthermore, rising disposable income levels, particularly in developing economies, enable people to buy new automobiles or modify old ones, driving growing demand for the elastomers used in these vehicles. Growing Adoption of Lightweight Vehicles: The increased emphasis on fuel efficiency and environmental responsibility is driving the automobile industry toward lighter vehicles, particularly range-focused electric vehicles. Lightweight elastomers are critical to this change, providing the necessary flexibility and performance while reducing overall vehicle weight. This translates to increased fuel efficiency and range for both traditional and electric vehicles. Key Challenges: Fluctuations in Raw Material Prices: Elastomers, which are mainly sourced from oil-based compounds, are subject to price changes that parallel those in the global oil market. These swings can have a considerable impact on elastomer manufacturing costs. Sudden price increases can reduce earnings, potentially raise car component prices, and make it harder for manufacturers to forecast and control expenses. Stringent Environmental Regulations: Growing environmental concerns have resulted in rules governing production processes and elastomer disposal. This provides a two-pronged challenge: tighter production rules may require cleaner procedures or ban certain elastomer kinds, raising production complexity and costs. Stricter elastomer waste disposal laws may also increase the cost of vehicle and component end-of-life management. Intense Competition from Substitute Materials: The automobile industry is continuously looking for cost-effective and performance-enhancing materials. This increases competition for elastomers from replacements such as lightweight and durable plastics or composite materials with high strength-to-weight ratios. To remain competitive, elastomer makers must focus on innovation, generating distinctive qualities that substitutes cannot simply imitate. Global Automotive Elastomers Market Regional Analysis Here is a more detailed regional analysis of the global automotive elastomers market: Asia Pacific: Asia Pacific is a vehicle manufacturing powerhouse, with major players including China, India, Japan, and South Korea. These behemoths produce a vast number of vehicles each year. The high volume of vehicle production directly translates into a significant demand for all automotive components, including elastomers. Elastomers play an important role in every car manufactured in this region, from tires and seals to hoses and other components. This results in a cost advantage for elastomer makers in this location over other regions of the world. This cost benefit can be passed on to automobile makers, potentially making vehicles more cheap to consumers. Furthermore, it enables elastomer manufacturers to become more competitive in the worldwide market. North America and Europe: Both North America and Europe have a lengthy history of automobile manufacture, with well-known automakers and an established automotive ecosystem. This established industry has resulted in a mature market for automotive elastomers, with a thorough grasp of their uses and performance requirements. Advancements could include producing lightweight elastomers to reduce vehicle weight and enhance fuel efficiency, as well as designing elastomers with lower rolling resistance for tires. North America and Europe, like other regions, are concentrating on reducing vehicle weight to enhance fuel efficiency and meet environmental standards. This trend creates a demand for innovative, lightweight elastomers that can replace heavier traditional materials while maintaining performance. These lightweight elastomers must maintain the strength, flexibility, and other qualities required for a wide range of automotive applications. Rest of the World: The “Rest of the World” region, encompassing South America, Africa, and the Middle East, represents a market with exciting growth potential for automotive elastomers. While it currently holds a smaller market share compared to established regions, several factors are converging to drive significant growth in the coming years. Many countries in this region are experiencing the growth of their domestic automobile sectors. This translates into an increased need for locally sourced automobile components, such as elastomers. Government policies on vehicle production, import levies on automotive components, and environmental rules can all have a substantial impact on the growth of the domestic automotive industry and, as a result, demand for elastomers. Supportive policies that stimulate local manufacturing and reduce import restrictions can hasten the expansion of the elastomer market. Strict environmental restrictions may require the use of more modern and eco-friendly elastomers, thus opening up new opportunities for the business. Global Automotive Elastomers Market: Segmentation Analysis The Global Automotive Elastomers Market is segmented on the basis of By Type, By Application and Geography. Automotive Elastomers Market, By Type Thermoset Elastomers (dominant segment) Natural Rubber Synthetic Rubber Thermoplastic Elastomers (TPEs) Based on Type, the global automotive elastomers market is segmented into Thermoset Elastomers and Thermoplastic Elastomers. The global automotive elastomer industry is dominated by thermoset elastomers, which include both natural and synthetic rubber. However, thermoplastic elastomers (TPEs) are predicted to be the fastest-growing area due to benefits such as recyclability and light weight. Automotive Elastomers Market, By Application Tire Non-tire Based on Application, the global automotive elastomers market is segmented into Tire and Non-Tire. The tire category dominates the global automotive elastomer market due to the large volume of elastomers required for tire tread wear resistance, traction, and low rolling resistance. While non-tire uses are important, tire production remains the primary source of elastomer demand. Expect quicker growth in the non-tire market due to the increased use of elastomers in automobile parts such as seals, gaskets, and hoses Key Players The “Global Automotive Elastomers Market,” study report will provide valuable insight with an emphasis on the global market. The major players in the market are The Dow Chemical Company, DuPont de Nemours, Inc., Lanxess AG, LyondellBasell Industries NV, Sumitomo Chemical Co., Ltd., Exxon Mobil Corporation, SABIC, Trinseo PLC, Wacker Chemie AG and Michelin Group. Our market analysis also entails a section solely dedicated to such major players wherein our analysts provide an insight into the financial statements of all the major players, along with its product benchmarking and SWOT analysis. The competitive landscape section also includes key development strategies, market share, and market ranking analysis of the above-mentioned players globally. Global Automotive Elastomers Market: Recent Developments In April 2024: Dow Chemical, a significant player in the elastomers market, has announced the release of a new line of bio-based elastomers generated from castor oil. This breakthrough meets the growing demand for sustainable materials in the automobile industry while providing equivalent performance to standard petroleum-based elastomers. In March 2024: Lanxess, another major elastomer maker, has announced a new line of lightweight thermoplastic elastomers built exclusively for electric vehicle battery enclosures. These materials have outstanding flame retardancy, dimensional stability, and thermal qualities, which are critical for EV battery safety and performance. In February 2024: Continental AG, a renowned automotive supplier, announced a collaboration with Siemens in to create and integrate AI-powered material modeling tools for elastomer development. This partnership intends to speed up the formulation process for new elastomers with specific qualities, improving performance and saving development time. In January 2024: The American Chemistry Council (ACC) and the Society of Automotive Engineers (SAE) announced a new project to promote the development and deployment of next-generation elastomers for self-driving vehicles. The program will focus on sensor integration, self-healing capabilities, and weather resilience for elastomeric components used in self-driving automobiles. Report Scope Report Attributes Details Study Period 2020-2031 Base Year 2023 Forecast Period 2024-2031 Historical Period 2020-2022 Unit Value (USD Billion) Key Companies Profiled The Dow Chemical Company, DuPont de Nemours, Inc., Lanxess AG, LyondellBasell Industries NV, Sumitomo Chemical Co., Ltd., Exxon Mobil Corporation, SABIC, Trinseo PLC, Wacker Chemie AG and Michelin Group https://www.verifiedmarketresearch.com /product/automotive-elastomers-market/