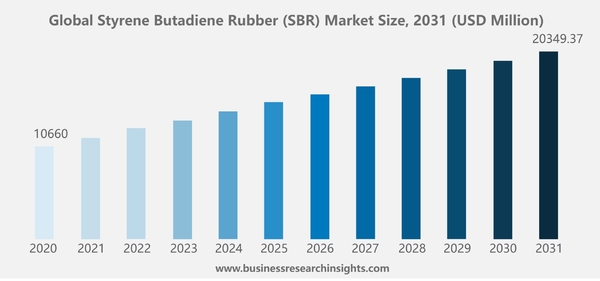

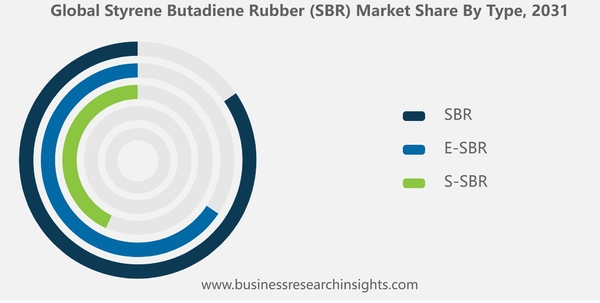

The global styrene butadiene rubber (SBR) market size was USD 10660 million in 2019. As per our research, the market is projected to touch USD 20349.37 million by 2031, exhibiting a CAGR of 5.5% during the forecast period. The global COVID-19 pandemic has been unprecedented and staggering, with the styrene butadiene rubber (SBR) market experiencing lower-than-anticipated demand across all regions compared to pre-pandemic levels. The sudden rise in CAGR is attributable to market’s growth and demand returning to pre-pandemic levels. A type of rubber known as styrene butadiene rubber (SBR) is produced using the two most common basic ingredients. One of the major varieties, Styrene Butadiene Rubber (SBR), offers good flex crack qualities and abrasion resistance at low temperatures. This product is applicable in several fields, including construction machinery, adhesives, and automobiles. The copolymer known as styrene-butadiene rubber (SBR) is created when styrene and butadiene are polymerized. Bulk, solution, and emulsion methods can all be used to create SBR. Due to SBR's superior qualities over other rubber types including natural and synthetic rubbers, the automobile sector is one of the market's main drivers, as is the growing use of SBR in adhesives and sealants. COVID-19 IMPACT: LOCKDOWNS AND RESTRICTIONS DISRUPTED THE SUPPLY, DEMAND AND HAVOCKED THE MARKET GROWTH The market was adversely affected by COVID-19. Production of styrene butadiene rubber (SBR), a raw ingredient used by all major industries, was temporarily halted. The disruption created by the COVID-19 epidemic prompted all industries to shut down, including construction, automotive, packaging, footwear, and others. As a result, there was a decrease in demand for styrene-butadiene rubber. In the upcoming years, though, it is anticipated that investments would increase and fuel market demand as businesses begin to recover. LATEST TRENDS "Adhesives Segment to Grow the Market Potentially" SBR, or styrene-butadiene rubber, is a crucial component of adhesives. High abrasion resistance, good flex fracture resistance, and high elasticity are the main uses of SBR-based adhesives in the construction industry, specifically in roofing sheets and tiles, automobile parts like bumpers, shoe bottoms, and footwear uppers. The main applications for styrene-butadiene rubber are in the production of pressure-sensitive adhesives and in the bonding of tufted carpets. Pressure-sensitive adhesive (PSA) usage has been driven by rising demand for tapes, labels, graphics, and others., and is anticipated to continue doing so during the projected period. In many applications, rubber-based PSAs are taking the place of conventional PSAs, which has led to an increase in the use of styrene-butadiene rubber in the adhesive sector. The demand for adhesives increased globally in 2022 and surpassed pre-pandemic levels when the restrictions loosened in 2021. STYRENE BUTADIENE RUBBER (SBR) MARKET SEGMENTATION By Type Based on type the market is classified as SBR, E-SBR, S-SBR and others. By Application Based on application the market is classified as automotive tire, footwear, polymer modification, adhesives and others. DRIVING FACTORS "Growing Demand from the Automotive Sector to Ride on the Market Share" The primary driver of market expansion is the automotive industries' increasing need for high-performance tyres. The tyre business is the one that uses styrene butadiene rubber the most. Tyre makers are now subject to labelling restrictions imposed by the countries; the tyres must bear labels indicating their effective fuel consumption, wet grip, and resistance to rolling. The market for styrene butadiene is being driven by the fast growth of the footwear sector. Because styrene butadiene rubber performs better and resists abrasion better, the market for this product is growing quickly.The market is further influenced by increased automotive sales as well as a growth in demand for rubber due to its qualities, which include low rolling resistance, abrasion resistance, good ageing ability, superior heat resistance, and wear resistance. In addition, the market for styrene butadiene rubber (SBR) is positively impacted by a rise in investment, research and development efforts, and the prosperous tyre manufacturing sector. "Low Prices and the Raw Material Availability to Raise the Market Share" Because of synthetic rubber's inherent benefits in terms of stability and physical qualities, natural rubber (NR) has been replaced in a wide range of applications. Additionally, there is a great deal of price volatility due to the declining supply of natural rubber. Using other sources, like SBR, has become essential in light of this circumstance. The price of raw materials is directly impacted by the price of crude oil. 2011 saw the peak price of crude oil, which was reflected in the USD 3.0/kilo price of butadiene during that same year. On the other hand, butadiene and styrene prices have dropped to all-time lows due to the recent decline in crude oil prices. Over the past few years, SBR prices have been significantly impacted by these variables. RESTRAINING FACTORS "Limited Heat, Oil and Weather Resistance to Restrain the Market Growth" Regarding heat resistance, SBR is not as good as other synthetic rubbers. Its usage is restricted in applications where exposure to elevated temperatures is a problem since it tends to soften and degrade at high temperatures. SBR is not very resistant to greases and oils. These compounds have the potential to cause SBR to expand, lose its mechanical qualities, and eventually deteriorate. This restricts its application in situations where oil contact is frequent. Weathering, which includes exposure to sunshine, ozone, and severe weather, can cause damage to SBR. In outdoor applications, UV light and ozone can shorten the surface's lifespan by causing cracking and deterioration. The poor resistance in heat, oil and weather combined have a substantial influence on styrene butadiene rubber (SBR) market growth. STYRENE BUTADIENE RUBBER (SBR) MARKET REGIONAL INSIGHTS "Asia Pacific Region to Lead the Market with Applications in Automotive and Robust Footwear Demand" In terms of revenue, the Asia Pacific region dominated, accounting for the major styrene butadiene rubber (SBR) market share. Asia-Pacific is the main region driving the need for EPDM. It is a key global consumer of adhesives and tyres. China and India are two of the world's leading automotive manufacturers. The world's largest car manufacturing sector is located in China. The Indian automobile sector hopes to grow vehicle exports by five times by 2031, with the country's car market predicted to reach at a greater revenue by that year. China is the world's biggest manufacturer and user of synthetic rubber, with 8,117 kt produced in 2021, an increase of a higher percentage year over year. On the plus side, the market is probably going to benefit from the strong demand coming from footwear applications. KEY INDUSTRY PLAYERS "Financial Players to Contribute Towards Expansion of Market" The industry is tremendously competitive, with numerous global and regional companies. Major players are contemplating numerous plans such as mergers and acquisitions, collaborations, the introduction of new and improved products, and joint ventures. LIST OF MARKET PLAYERS PROFILED China National Petroleum Corporation (China) Kumho Petrochemical Co., Ltd (South Korea) ZEON Corporation (Japan) Trinseo S.A. (U.S.) LANXESS Aktiengesellschaft (China) The Goodyear Tire & Rubber Company (U.S.) Zhejiang Vitile Co., Ltd (China) Jiangsu Shenhua Chemical Co., Ltd (China) Zhechen Rubber (China) Fujian FuXiang Chemical Co., Ltd (Japan) LG Chemicals (South Korea). REPORT COVERAGE The report includes a SWOT analysis as well as information on potential developments. The examination of a variety of elements that encourage market expansion is included in the research report. This section also includes a wide range of market categories and applications that may have an impact on the market in the future. The details are based on current trends as well as historical turning moments. The current situation of the market's components and prospective growth areas in the coming years. Styrene Butadiene Rubber (SBR) Market Report Coverage REPORT COVERAGE DETAILS Market Size Value In US$ 10660 Million in 2019 Market Size Value By US$ 20349.37 Million by 2031 Growth Rate CAGR of 5.5% from 2019 to 2031 Forecast Period 2021-2031 Base Year 2023 Historical Data Available Yes Regional Scope Global Segments Covered Type and Application https://www.businessresearchinsights.com/market-reports/styrene-butadiene-rubber-sbr-market-109327