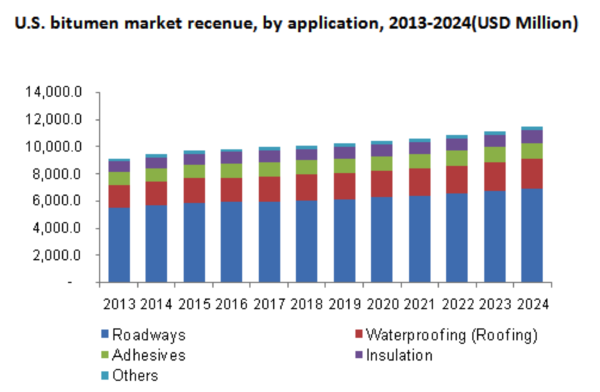

The global bitumen market size was USD 66.10 billion in 2015 and is expected to witness significant growth over the next eight years owing to increasing use in various applications including roadways, waterproofing, insulation, and adhesives. Rapid urbanization in emerging markets has contributed to rising in infrastructure activities. This has resulted in increasing demand for the product. The asphalt (bitumen) binder is an essential element in various roadways applications on account of its higher strength, durability, and resilience. Concrete contains a small percentage of asphalt (bitumen) which is acting as a binder to enhance its resistance characteristics, which is expected to boost demand over the forecast period. Growing demand for infrastructure on account of growing the population, improving the standard of living is projected to bolster market growth over the forecast period. Increasing awareness about climate changes, along with global warming will drive roofing requirements which in turn is supposed to drive product demand over the next eight years. Declining oil prices has resulted in tight raw material supply and caused price fluctuation and volatility in the market, which will restrain industry expansion over the forecast period. The long supply chain is a key feature owing to bitumen being a strong product to handle. This feature is being challenged as large contractors have begun directly selling to the refineries. Roadways were the largest application segment in 2015, estimated at USD 39.29 billion. Road connectivity is the most crucial feature of any developed economy. This factor has resulted in market expansion on account of growing need for roads in emerging economies. The efficient transportation system in various countries including India, China, and the U.S. will stimulate product demand in the near future. Rising demand for paving applications across different regions of the world especially in Asia Pacific and the Middle East will promote product growth over the next eight years. Growing modern construction systems having waterproofed flat roofs will stimulate bitumen demand over the forecast period. Asia Pacific was the dominant market in 2015 and accounted for over 33.0% of the global volume and will show growth on account of rising construction industry growth in India, China, Thailand, and Vietnam. Moreover, the presence of the major market players in the region including ExxonMobil, Shell Bitumen, and British Petroleum will augment industry expansion over the next eight years. Also, Asia Pacific will increase its bitumen consumption owing to the extensive road network in the region. North America bitumen market was valued over USD 19.00 billion in 2015 and is expected to witness significant expansion on account of the growing need for rebuilding existing assets such as bridges, highways, and buildings. MEA is expected to show significant volume gains with CAGR of 2.0% from 2016 to 2024 as a result of growing construction sector primarily in UAE and Qatar coupled with rising infrastructure activities in the region. Also, increasing government spending on construction will further propel industry growth in the near future. The global bitumen industry is characterized by integration through raw material supply to the manufacturing stages. Companies including Valero Energy Corporation, NuStar Energy, Suncor Energy, Athabasca Oil Corporation, Imperial Oil Limited, Syncrude are engaged in producing crude bitumen from oil sands. Companies including Sinopec, Indian Oil Corporation, Nippon Oil Corporation, ExxonMobil, Shell Bitumen, Petróleos Mexicanos (PEMEX) Nynas AB, Marathon Oil Corporation captively consume crude bitumen, refine it and then use it in various applications. Companies including Imperial Oil Limited, Valero Energy Corporation, Petróleos Mexicanos (PEMEX) and Shell are integrated across three stages of the value chain. Kraton Performance Polymers has developed a Highly Modified Asphalt Technology (HiMA) to cater to the ever increasing demand from the paving and roofing sectors. This technology offers a broad range of modification options including styrene-isoprene-styrene, styrene-butadiene-styrene for high performance and superior quality. Kraton Performance Polymer and British Petroleum are engaged in various grades of cost effective waterproofing applications that provide with high water resistance and ability to withstand extreme temperatures. Cenovus Energy Inc. and Suncor Energy Inc. are some of the companies which have cut down their capital expenditures owing to the declining oil prices. The Canadian bitumen has a huge demand in the U.S. due to the presence of a vast number of processing units and refineries.