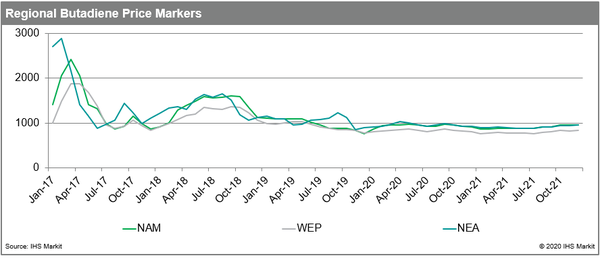

The year 2019 was an interesting one for butadiene market players, and in many ways not what we expected. The year was defined by weak demand growth and a more comfortable market balance, despite significant planned maintenance outages. There were three main drivers that caused deviation from the 2019 forecast: automotive market weakness, seasonal strength of LPG versus ethane as cracker feedstock in the US, loss of butadiene extraction capacity because of the TPC accident. This accident did not have a major impact on the 2019 market as it happened late in the year. The Chinese economy will be a defining variable, it is expected to drop slightly in comparison to 2019. This raises questions regarding the strength of the automotive market and therefore demand for tires, synthetic rubber, and butadiene. Oil prices are likely to be fairly stable before easing in the second half of 2020. Natural gas is expected to favor low prices with natural gas-related. commodities being advantaged over oil-related commodities. This would seem to support a relatively flat cost structure for butadiene production. Butadiene prices in the three major regions will be relatively flat with a gradual increase. The combination of flat energy prices and an improved supply/demand balance outlook drive the price forecast. The increased butadiene production in North America and China should put downward pressure on imports which is an indication of a lengthening market balance. What are the most significant forecast risks in 2020 Global economic turmoil impacting butadiene demand. While our economic forecasters indicate both upside and downside possibility from their outlook, it seems that the butadiene outlook would be more affected by downside deviations. Global recession is not in our base case, but it is becoming an increasingly credible alternate case. Source:https://ihsmarkit.com/research-analysis/major-butadiene-market-trends-for-2020.html

2020 will present a continuation of some of these trends as well as some additional challenges and opportunities to the market.

Butadiene Market Key Trends for 2020

Global economic growth is expected to deteriorate slightly in the key C4 markets of the United States, West Europe, and China with IHSM cautiously optimistic about the economic situation and outlook. Large ticket purchases, such as automobiles, are at greater risk during high periods of economic uncertainty in these key markets.

Ethylene crackers will continue to favor lighter feedslate. The growing ethylene demand will primarily be supplied by increased production in North American and China.

Crude C4 availability is unlikely to be a significant global market driver. We do not expect crude C4 markets to be tight as North America and China have additional ethylene production. This will result in softer import demand affecting the price differentials between the key regions.

Unplanned outages for either ethylene crackers or butadiene extraction units could cause significant market disruption. The risk is especially amplified by the fact that in the US, the lack of spare extraction capacity. The global market should still remain well supplied, but there could be shorter term regional disruption as deep water spot trade takes some time to respond to demand.

Energy price volatility, either upside or downside. It is likely there is more downside risk than upside, although not by too much. This could have an impact on ethylene cracker feedslates and butadiene production costs.

Ethylene cracker feedstock deviations from the forecast. Right now, this is most likely a North America dynamic. We expect the potential market risk to be increased butane cracking. However, ethane could also remain strongly favored. In this case, it would seem that the market balance would be somewhat tighter in the US, driving price differential between the US and West Europe higher. This would lead to increased imports of butadiene and butadiene derivatives.

Delays in start-up of new ethylene crackers in China where as many as five new crackers are scheduled for this year. If there are delays, the increased butadiene supply from China that is currently expected to soften its domestic market, and even impact rest of Northeast Asia through its potential exports, would be delayed.