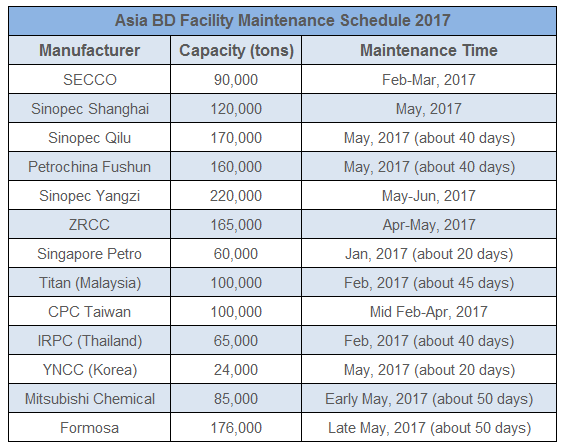

In the first month of 2017, SBS (Styrene-Butadiene-Styrene) in the Chinese market still maintains the high price as in 2016, and continues to rise despite the largely reduced demand from SBS’s downstream market due to the Lunar New Year. China's SBS rubber price trend is mostly dominated by Asia butadiene (BD) price since October, 2016. The SBS price continues to be fueled by the surging price of BD after the Lunar New Year of 2017. The continuous rise of Asia BD price is mainly impacted by tight supply, strong demand, and other favorable factors. BD’s production capacity will be restricted to some extent in the future as light cracking raw materials are used and more MTO (Methanol to Olefins) projects go into operation. According to incomplete statistics, the facility maintenance schedules of major Asia BD manufacturers are concentrated in the first half year of 2017 as shown in the table below. With the production capacity of 925,000 tons involved in China, this will certainly affect the supply of BD. Tight supply of BD will directly drive its price rise. In addition, the increasing demand for BD, one of the major raw materials for manufacturing synthetic rubber, for tire market will keep BD market strong in the short run. The new national vehicle standard GB1589-2016 requires the total weight of 6x2 tractors to decrease from 55 tons to 46 tons, thus driving a large number of users to replace 6x2 tractors with 6x4 ones. The newly implemented "Regulations on the Administration of Oversize Highway Freight Vehicles" and "Special Action Plan for Remedying Illegal Oversize and Overweight of Highway Freight Vehicles" crack down hard on oversize and overweight freight vehicles. The transport capacity of single heavy truck is generally reduced by about 10%-20%, propelling numerous heavy truck users to change or buy new vehicles to meet the capacity needs. This leads to the soaring sales of China’s heavy truck market, which further makes the demand for rubber to exceed the supply.